Family Wealth Transfer 2024

Over a quarter of wealthy individuals are expected to pass on their fortunes in the next decade. The values and approaches to wealth transfer among these individuals and their families have significant implications for a wide range of organizations, including family offices and financial services providers, the luxury goods industry, and the non-profit and charity sectors.

Altrata’s latest global wealth transfer report – powered by Wealth-X data – examines the growing focus among the wealthy on succession planning and the transition process. Our focus is on the global population of wealthy individuals with a net worth of more than $5 million, with a particular emphasis on those with fortunes in excess of $100 million.

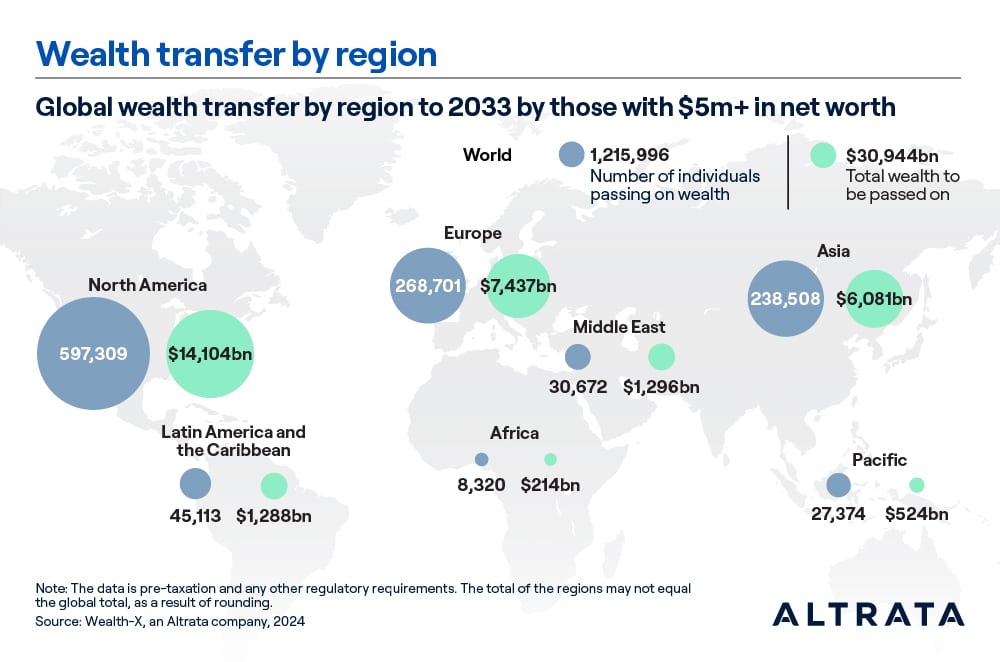

Altrata’s research shows that among individuals with a net worth of $5 million or more, over 1.2 million people are expected to collectively pass on almost $31 trillion over the next 10 years.

This report distills insights from Altrata’s comprehensive data and interviews with four of our sector specialists. We discuss the major themes and generational shifts that will influence the wealth transfer process and donor engagement over the coming years, and provide a fuller understanding of the wealthy individuals who will be passing on their fortunes.

Explore key findings.

- Some 1.2 million individuals worth more than $5m are expected to pass on collective wealth of almost $31trn over the next 10 years. This sum is greater than the GDP of the US and is more than 10 times the market capitalization of technology giant Microsoft.

- Generation X will be first in line to inherit from their wealthy parents. Much is often made in the media of millennial and Generation Z inheritors but, in fact, most heirs (excluding partners) are currently in their mid-to-late 40s. Millennials and the younger Gen Z are more likely to receive sums from their grandparents – legacies that will often be less substantial than if they had been inherited from their parents.

- Family wealth transfer will be influenced by shifting global trends and an increasingly complex geopolitical environment. Some major trends include complex succession planning for increasingly globalized wealthy families (underlining the crucial role of expert advisors), the disparity between the values, experiences and aspirations of wealth holders (often founders) and their younger benefactors, and an increase in wealth being passed on during the lifetime of the head of a family rather than solely upon death, requiring early engagement and preparation.

Maeen Shaban is an expert in understanding the wealthy, specifically their populations, growth and trends that affect them across the globe. He is a lead author of Wealth-X’s main thought leadership reports, including the World Ultra High Net Worth Report, the Billionaire Census and the High Net Worth Handbook. Maeen continues to work with clients such as JP Morgan, Goldman Sachs, Rolls Royce, Loreal and Bill & Melinda Gates Foundation. He holds First Class Honours in Financial Engineering, has completed CFA Level II and conducted post graduate research on sovereign offshore investment strategies.