Our recent report, The Role of the CFO 2022, looks at more than 1,400 CFOs who lead the major publicly traded companies across 16 countries around the world.

Given the speed at which market conditions, business strategies and operational structures have changed in recent years, businesses are more aware than ever of the crucial role the chief financial officer (CFO) plays in shaping and driving a company’s strategic direction. As the role continues to evolve from being predominantly financial to one that encompasses broader strategic oversight, businesses must consider how best to recruit, retain and bring out the best in their finance leadership.

BoardEx analyzed the current CFOs at the corporations of the major indices across 16 countries. The analysis dove deeper on the CFOs of the US, Canada, the UK, France, Germany, Italy and Spain. The research encompassed more than 1,400 companies.

Let’s take a look at the common themes revealed in this study:

Age

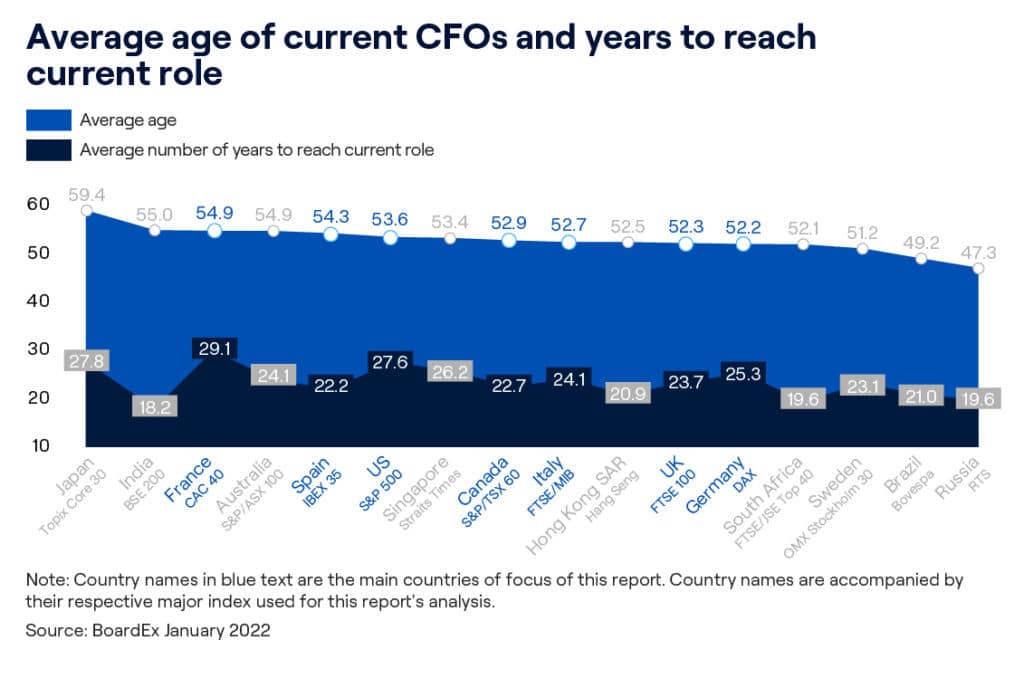

On average, CFOs at major listed companies are in their early to mid-50s and have 20+ years of experience.

The age profile is similar in most leading markets, where the average 52-55 years, but there are several outliers. Leading CFOs in Russia are, on average, six years younger than their global counterparts, with those in Brazil also aged under 50.

When it comes to professional experience, there are clear differences across major markets. Professional experience of around 28 years is the norm in Japan, France and the US, which is five years longer than in other large European and North American markets.

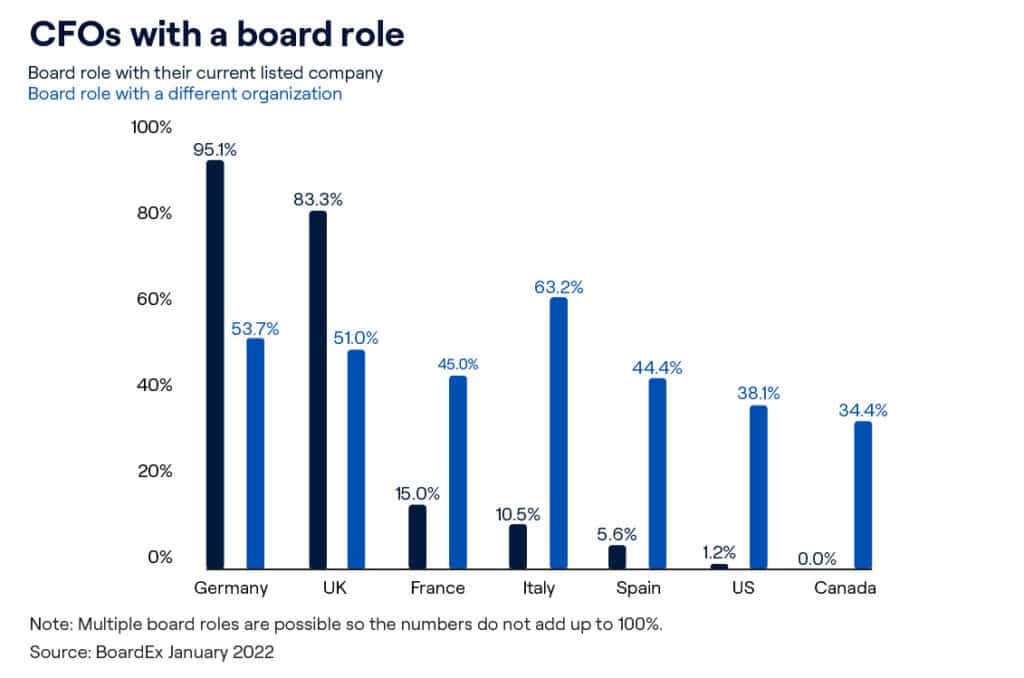

Board Experience is Common, in the UK

83% of CFOs in the UK sit on the board of their company, compared to only 1% in the US. Across the big five markets in the study, about 50% of CFOs hold a non-executive board position elsewhere (the highest share is in Italy). This compares with one in three leading CFOs in the US and Canada serving as board members at another organization

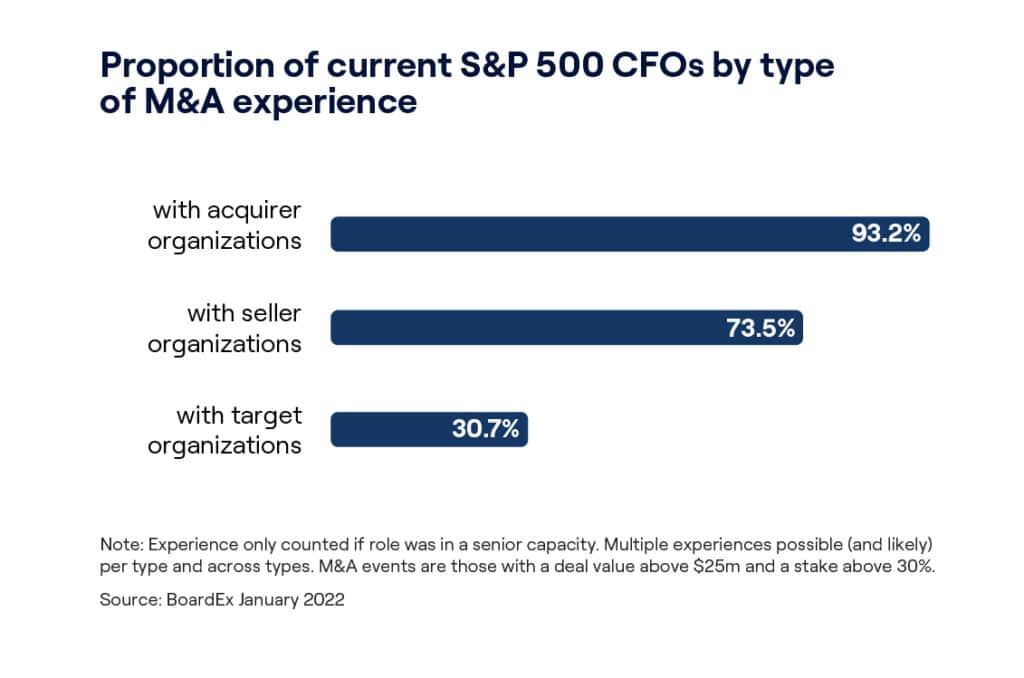

M&A Experience

M&A experience is common. Involvement in M&A deals is a common experience for most leading CFOs at listed companies. In the US, more than 90% of CFOs have overseen – and have often been the architect of – the acquisition of a target business, with three-quarters having engaged with seller organizations. Given the relatively frequent occurrence of M&As among large listed companies, such experience appears almost essential for a CFO role.

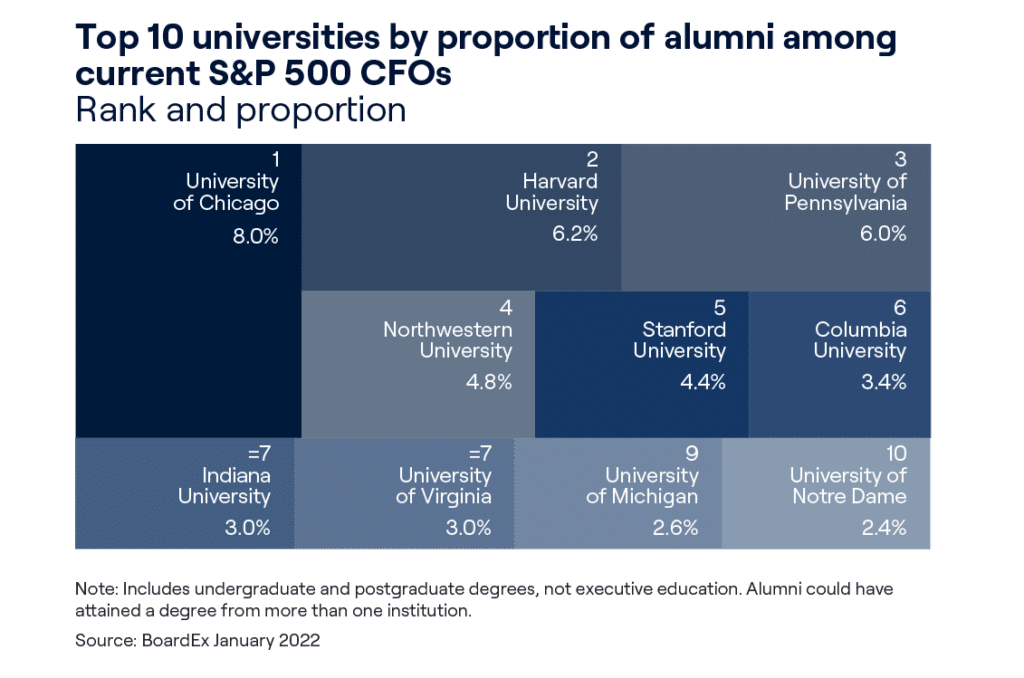

Education Matters

Prestigious universities with highly regarded business schools produce the most CFO alumni in the US. The foremost institutions are the University of Chicago, Harvard University and the University of Pennsylvania. Together, these universities account for 20% of leading CFOs’ undergraduate or postgraduate degrees. This is a significant proportion given the huge number of universities and business schools across the US. Almost half of S&P 500 CFOs gained a degree from one of just 10 universities, of which three are Ivy League schools.

Your resume counts

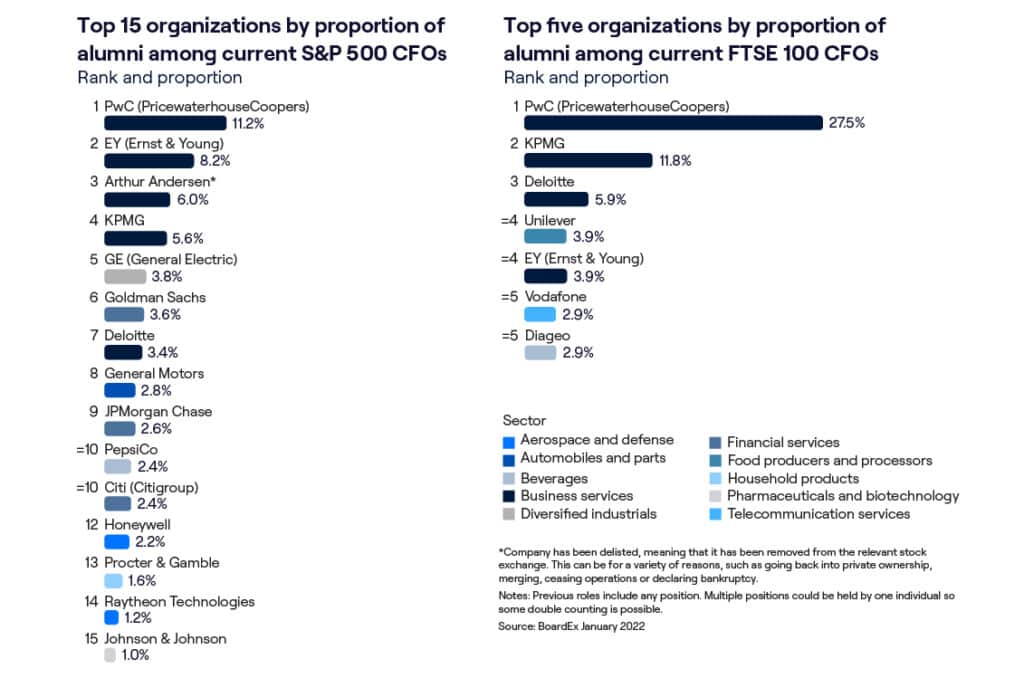

Many leading CFOs at US- and UK-listed companies have worked at the ‘Big Four’ professional-services firms, with PwC leading the list. Additionally, major professional – or financial services groups are the most common past employers. Traditional corporations, like GE, PepsiCo and General Motors rank among the top 10 companies to have previously employed leading CFOs in the US, which is a nod to the skill sets, brand association and connections their employees gain from working at such companies.

The Modern CFO

The role of the CFO has substantial responsibility for shaping and driving a company’s strategic direction. The parameters of the role are broad and more diverse as ever as CFOs become involved in the formulation and execution of commercial, technological and financial business strategies. CFOs now are required to have a deep understanding of all facets of the company as well as wider societal, technological and regulatory trends.

All of this serves to emphasize the importance and responsibility of the modern CFO in shaping and driving a company’s strategic direction, while also ensuring operational resilience in an often uncertain economic environment and rapidly evolving digital space. This, in turn, demonstrates how crucial it is for businesses to recruit and retain the right talent in finance leadership, aligning an individual’s capabilities and expertise with not only the situational demands of the senior role but also the expectations, constraints and culture of the organization.