How many billionaires are there in the world?

Altrata’s Billionaire Census 2025 – the 12th edition – offers a comprehensive overview and analysis of the world’s billionaire population. Modest in size, but wielding an increasingly disproportionate influence across global markets and society, the billionaire class holds an immense level of wealth. 2024 was another year of dynamic gains in billionaires’ collective net worth, which is now valued in excess of $13 trillion.

Utilizing our extensive database of the global wealthy, we provide insight into the billionaire population including the distribution of their wealth, the key drivers and regional wealth trends, and the ranking of the leading billionaire countries and cities. Altrata’s comprehensive database provides unrivaled insight into the status of the world’s wealthiest individuals and their characteristics, making the Billionaire Census 2025 an essential read for any provider looking to prospect for and engage with individuals in this highly exclusive demographic.

How much wealth do billionaires have?

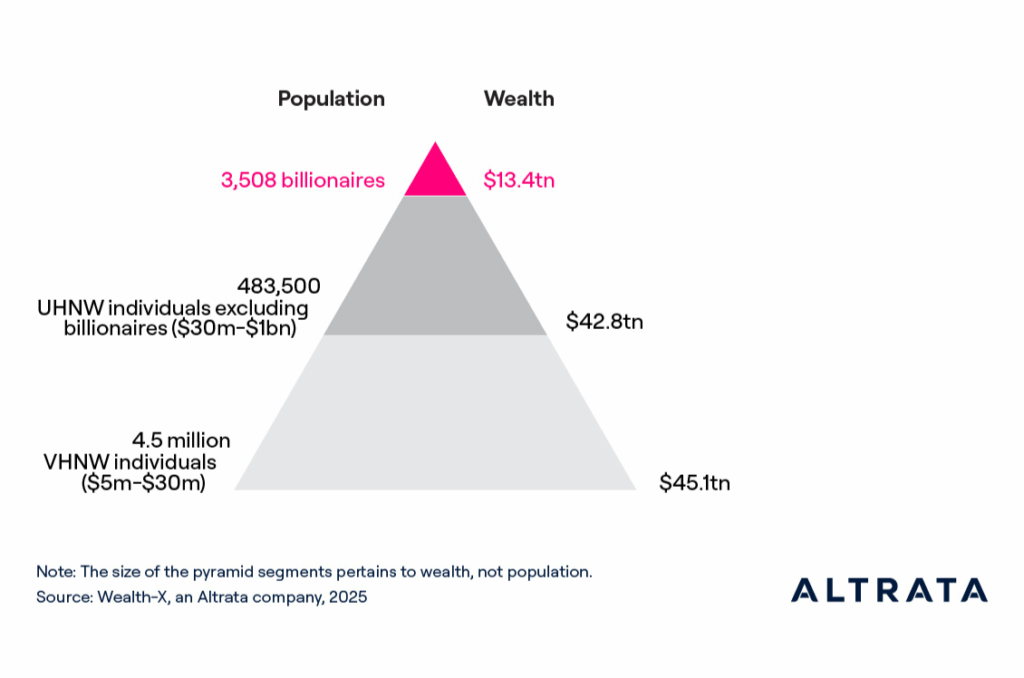

The uneven distribution of global wealth is evident across all levels of society and wealth tiers, and is particularly stark when examining the world’s super rich. In 2024, the billionaire class represented just 0.07% of the approximately 5 million individuals globally with fortunes in excess of $5 million; however, they held around 13% of this group’s total stock of wealth.

Population and global wealth by major giving tier in 2024

Narrowing the focus to just the ultra high net worth (UHNW) segment – numbering about 487,000 individuals, each with a fortune of more than $30 million – the billionaire population comprised only a 0.7% share, yet their collective net worth of $13.4 trillion accounted for an outsized 24% of total UHNW wealth.

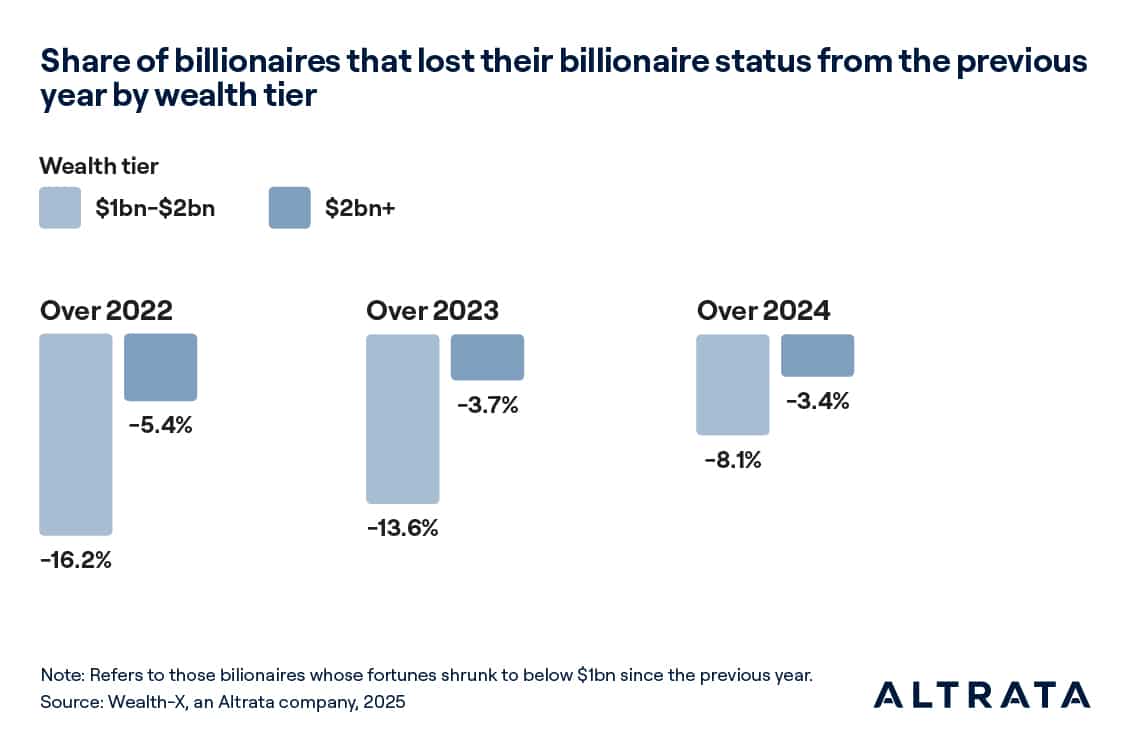

Is it difficult maintaining billionaire status?

On average, in each of the past three years, around a 10th of the individuals who were worth between $1 billion and $2 billion the previous year fell out of the billionaire club. This share declines among those with larger fortunes.

Staying in the billionaire club

Billionaires with at least $4.2 billion have a 99% likelihood of maintaining their membership of the billionaire club the following year. Those with a net worth of $1 billion – $2 billion, whose primary business focus was a publicly owned company, were more than twice as likely to drop out of the billionaire club than individuals with a privately owned enterprise. This highlights the exposure of portfolio valuations to potentially volatile shifts in stock market sentiment or sector-specific downturns.

Where do billionaires live, work and play?

Top billionaire cities

The distribution of the billionaire population across regions has evolved steadily over the past decade, but the attraction to the wealthy of the high-end business, cultural and lifestyle opportunities offered by the premier global cities remains strong.

Against a global backdrop of rising billionaire wealth, most of the top-ranked cities increased their super-wealthy populations, with Paris, Singapore and Los Angeles registering the strongest relative growth. The glitzy commerce and retail hub of Dubai continued its recent track record of steady gains, while modest advances by Chicago and Houston underlined the broad-based expansion of billionaire wealth across the US.

Other key insights explored within Altrata’s Billionaire Census 2025 include:

- The global billionaire population grew by 5.6% in 2024 to reach a new high of 3,508 individuals

- 26 ‘super billionaires’ account for a combined 21% of total billionaire wealth, up from just 4% a decade ago

- North America reinforced its status as the world’s leading billionaire region

- The top 15 countries are home to just over three-quarters of the global billionaire population

- Those in the billionaire class of 2015 whose wealth was tied to technology or the hospitality and entertainment sector have enjoyed by far the strongest gains in net worth over the past decade

Understanding the scale, composition, characteristics and shifting geography of the global billionaire population is essential for organizations seeking to navigate the markets, industries and networks shaped by the world’s most powerful individuals.

Methodology

This report uses Altrata’s unique and proprietary wealth data, the world’s most extensive collection of curated research and intelligence on the wealthy. Our database provides insights into their financial profile, career history, known associates, affiliations, family background, education, philanthropic endeavors, passions, hobbies, interests, and much more. Our proprietary valuation model (as defined by net worth) assesses all asset holdings, including privately and publicly held businesses and investable assets. Wealth-X uses the primary business address as the determinant of a billionaire’s location. References to $ or dollars refer to US dollars.

Analysis of the data and additional insights were provided by Altrata’s Analytics team. Leveraging Altrata’s databases and its own data models, Altrata Analytics provides customizable data assets tailored to an organization’s needs.

About the authors

Maya Imberg is the Head of Thought Leadership and Analytics at Altrata. She is responsible for spearheading the company’s thought leadership efforts and overseeing its analytics and predictive modeling services commissioned by clients. She joined Altrata’s Wealth-X in 2016 as Director of Custom Research responsible for secondary research, data analytics and branded content.

Maya has over fifteen years of experience in research, spanning market research, macroeconomics and financial services. Prior to joining Wealth-X, Maya held a variety of consultant and economist roles at the Economist Intelligence Unit and spent a number of years working for Datamonitor’s Financial Services practice. Maya holds an undergraduate and MSc degree in economics and comparative politics from the University of Pennsylvania and London School of Economics respectively.

Maeen Shaban is Director of Research and Analytics at Altrata, where he leads a revenue-generating analytics function delivering bespoke insights on global wealth and influence. With a background in financial engineering and advanced research into sovereign wealth strategies, Maeen brings deep analytical expertise and commercial acumen to the evolving landscape of private wealth.

He plays a central role in shaping Altrata’s global thought leadership program, co-authoring its flagship publications including the World Ultra Wealth Report and the Billionaire Census. His work draws on proprietary datasets, financial modelling, and targeted research to support strategic decision-making across the private wealth, luxury, and philanthropic sectors.

Maeen’s current focus includes wealth transfer trends, the role of single family offices, and the spending priorities of the ultra-wealthy—insights that are increasingly valuable to businesses navigating the expectations and behaviors of today’s most affluent individuals and families.

Bettina Fésüs-Lengyel is an Associate Analyst on the Thought Leadership & Analytics team at Altrata. She is responsible for uncovering meaningful insights from complex datasets and shaping data-driven narratives that inform Altrata’s thought leadership and client-facing analysis.

Bettina has experience spanning chemical engineering and data analytics, with skills in SQL, statistical techniques, and data storytelling to support decision-making and business growth. Prior to joining Altrata, she held a variety of chemical engineering and data analyst roles. Bettina holds a bachelor’s degree in chemical engineering from the University of Pannonia.