How many ultra high net worth individuals are there in the world?

Altrata’s World Ultra Wealth Report 2025 – the 13th edition of its kind – provides a comprehensive analysis of the global ultra high net worth (UHNW) population. This exclusive group of wealthy individuals, each with a net worth in excess of $30m, has grown rapidly in size and influence over the past decade, accumulating immense collective wealth that now totals almost $60tn – double the annual GDP of the US.

Altrata’s comprehensive database on the wealthy and its detailed Wealth and Investable Assets Model provide unrivaled insight into the world’s UHNW population, its characteristics and the constantly changing landscape of wealth creation, making it an essential resource for any organization looking to prospect for and engage with individuals in this exclusive demographic.

By 2030, Altrata forecasts the global ultra wealthy population will grow to 676,970 individuals, up by 31% from H1 2025 and an increase of 166,160 people.

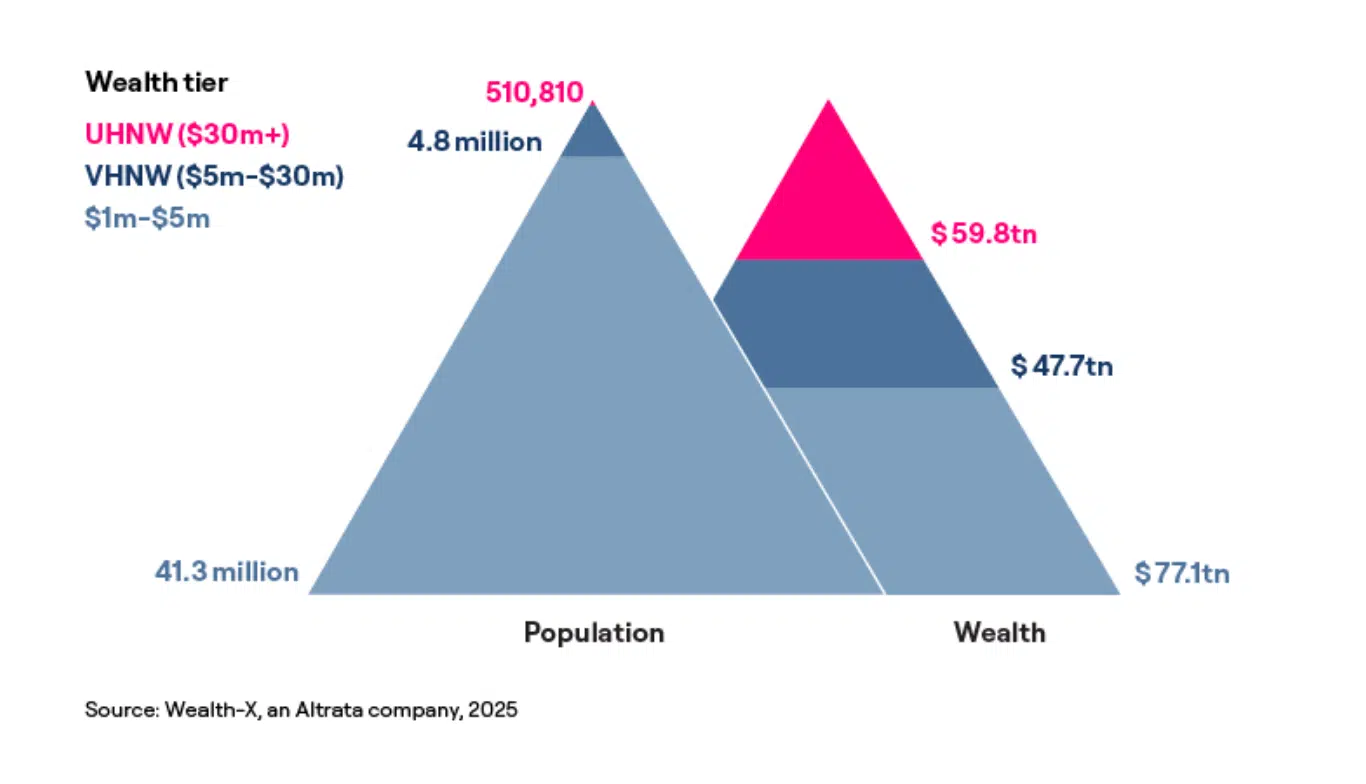

The ultra wealthy hold a substantial proportion of global net worth

At the end of June 2025 there were an estimated 41.3 million high net worth (HNW) individuals around the world, each with wealth in excess of $1m. Within this relatively affluent group, the UHNW population numbered 510,810 individuals, each holding substantial fortunes in excess of $30m.

The ultra wealthy population has grown 7x faster than the global adult population over the past two decades.

The ultra wealthy represent just 1.1% of the global HNW class, but their cumulative share of wealth is significantly larger. At $59.8tn, the total net worth of the UHNW cohort accounted for 32.4% of the wealth held by all HNW individuals, highlighting the considerable influence and privileged standing of this exclusive segment.

Global population and wealth by major wealth tier in June 2025

Our data (going back to 2004) shows that over this period the size of the ultra wealthy class has swelled rapidly, outpacing the expansion of the global adult population by a factor of seven.

Insight into the world’s wealthiest individuals

Globally, the ultra wealthy account for:

$290 billion

of luxury goods

spend, equivalent

to 21% of total

individual spend1

$207 billion

of philanthropic

donations, equivalent

to 36% of all giving

by individuals2

$30 trillion

of investable

assets, equivalent

to 10% of global

investable assets3

Source: Wealth-X, an Altrata company. Estimates using Wealth-X data and

Bain/Altagamma for overall luxury goods spend.

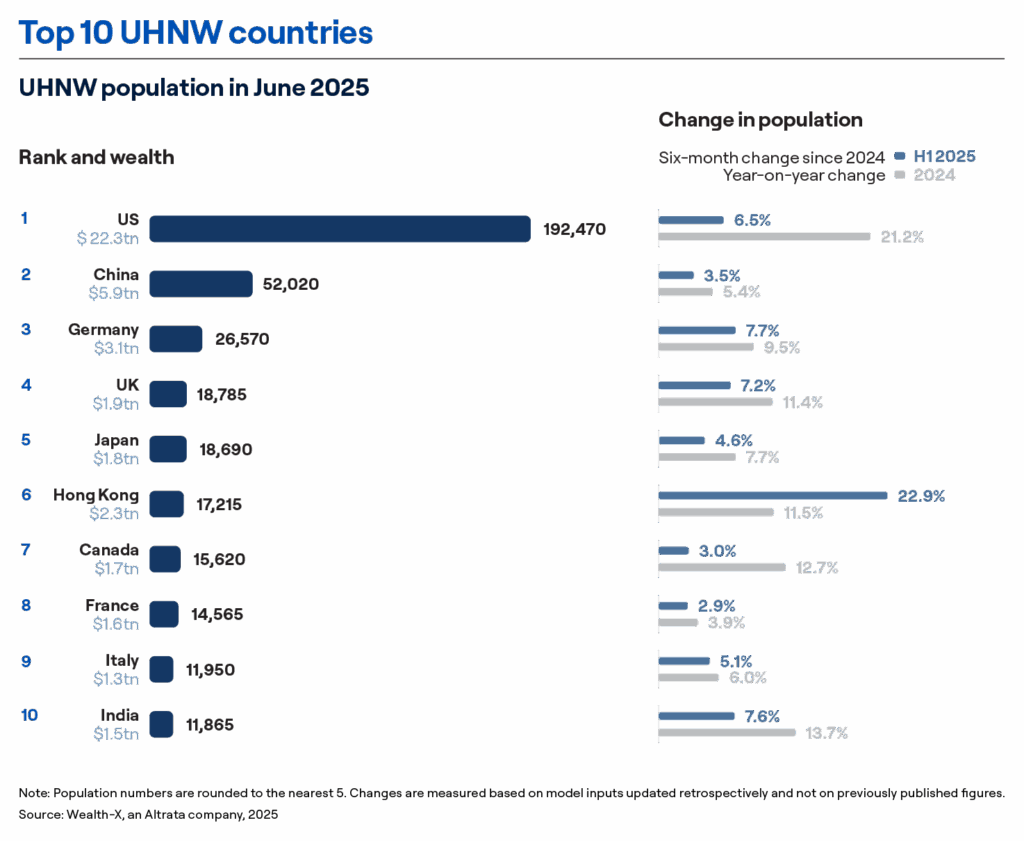

Where do the wealthiest people in the world live in 2025?

Top 10 UHNW countries

Three-quarters of the UHNW population reside in just 10 countries, underlining the influential status of the world’s largest wealth markets and the focused opportunities for companies and organizations that target and/or cater to the global rich.

Other key insights explored within Altrata’s World Ultra Wealth Report 2025 include:

- The ultra wealthy make up just 1% of the global millionaire population yet hold 32% of this group’s total wealth.

- By 2030, Altrata forecasts the global ultra wealthy population will grow to 676,970 individuals, up by 31% from H1 2025 and an increase of 166,160 people.

- Asia is expected to see the strongest growth in its UHNW population, but North America will remain the largest ultra wealth region by far.

- There will be outsized UHNW growth in India. It has four of the top ten growth cities, including Bengaluru, Mumbai, Hyderabad and Delhi.

Understanding the size, distribution, and evolving dynamics of the global ultra wealthy population is essential for financial services, luxury brands, real estate, nonprofits, and other industries that depend on engaging the world’s most influential clients and donors.

Methodology

This report leverages two of Altrata’s unique products: the Wealth-X Database, the world’s most extensive collection of curated research and intelligence on the wealthy, and RelSci’s Relationship Mapping Database. To profile and size the ultra wealthy we use the Wealth-X Database and our Wealth and Investable Assets Model respectively.

The Wealth-X Database provides insights into their financial profile, career history, known associates, affiliations, family background, education, philanthropic endeavors, passions, hobbies, interests and much more. Our wealth model produces statistically significant estimates for total private wealth and estimates the size of the population by level of wealth and investable assets for the world and each of the top 70 economies, which account for 98% of world GDP. The model uses residency as the determinant of an individual’s location.

Our connections data was leveraged from Altrata’s RelSci and Wealth-X. RelSci’s Relationship Mapping Database covers 10 million influential individuals and 2 million organizations.

The full methodology can be found at the end of the report.

Footnotes

1 Refers to 2024 (estimate) data. Source: Wealth-X, an Altrata company. Based on estimates using Wealth-X data and Bain/Altagamma.

2 Refers to 2023 data. Source: Wealth-X, an Altrata company.

3 Refers to 2024 data. Source: Wealth-X, an Altrata company.

About the authors

Maya Imberg is the Head of Thought Leadership and Analytics at Altrata. She is responsible for spearheading the company’s thought leadership efforts and overseeing its analytics and predictive modeling services commissioned by clients. She joined Altrata’s Wealth-X in 2016 as Director of Custom Research responsible for secondary research, data analytics and branded content.

Maya has over fifteen years of experience in research, spanning market research, macroeconomics and financial services. Prior to joining Wealth-X, Maya held a variety of consultant and economist roles at the Economist Intelligence Unit and spent a number of years working for Datamonitor’s Financial Services practice. Maya holds an undergraduate and MSc degree in economics and comparative politics from the University of Pennsylvania and London School of Economics respectively.

Maeen Shaban is Director of Research and Analytics at Altrata, where he leads a revenue-generating analytics function delivering bespoke insights on global wealth and influence. With a background in financial engineering and advanced research into sovereign wealth strategies, Maeen brings deep analytical expertise and commercial acumen to the evolving landscape of private wealth.

He plays a central role in shaping Altrata’s global thought leadership program, co-authoring its flagship publications including the World Ultra Wealth Report and the Billionaire Census. His work draws on proprietary datasets, financial modelling, and targeted research to support strategic decision-making across the private wealth, luxury, and philanthropic sectors.

Maeen’s current focus includes wealth transfer trends, the role of single family offices, and the spending priorities of the ultra-wealthy—insights that are increasingly valuable to businesses navigating the expectations and behaviors of today’s most affluent individuals and families.

Bettina Fésüs-Lengyel is an Associate Analyst on the Thought Leadership & Analytics team at Altrata. She is responsible for uncovering meaningful insights from complex datasets and shaping data-driven narratives that inform Altrata’s thought leadership and client-facing analysis.

Bettina has experience spanning chemical engineering and data analytics, with skills in SQL, statistical techniques, and data storytelling to support decision-making and business growth. Prior to joining Altrata, she held a variety of chemical engineering and data analyst roles. Bettina holds a bachelor’s degree in chemical engineering from the University of Pannonia.