The first World Ultra Wealth Report published by Altrata — and the tenth edition powered by Wealth-X data — provides in-depth analysis of the ultra high net worth (UHNW) population — an exclusive group of wealthy individuals located across the globe, each with net worth in excess of $30m.

The report explores the distribution of wealth among the global rich, and examines the considerable wealth enjoyed by the ultra wealthy demographic. It shines a spotlight on the characteristics of ultra wealthy women who account for a rise of sharing of wealth.

It shines a spotlight on the characteristics of ultra wealthy women who account for a rise of sharing of wealth. It also explores their philanthropic giving, and, using insights from RelSci (an Altrata company), for the first time, we compare political donations among ultra wealthy men and women in the US.

Wealth-X’s comprehensive database and newly updated Wealth and Investable Assets Model provide unrivaled insight into this select group of individuals, their characteristics and the constantly changing landscape of wealth creation, making it an essential read for any provider looking to prospect for and engage with individuals in this unique and exclusive demographic.

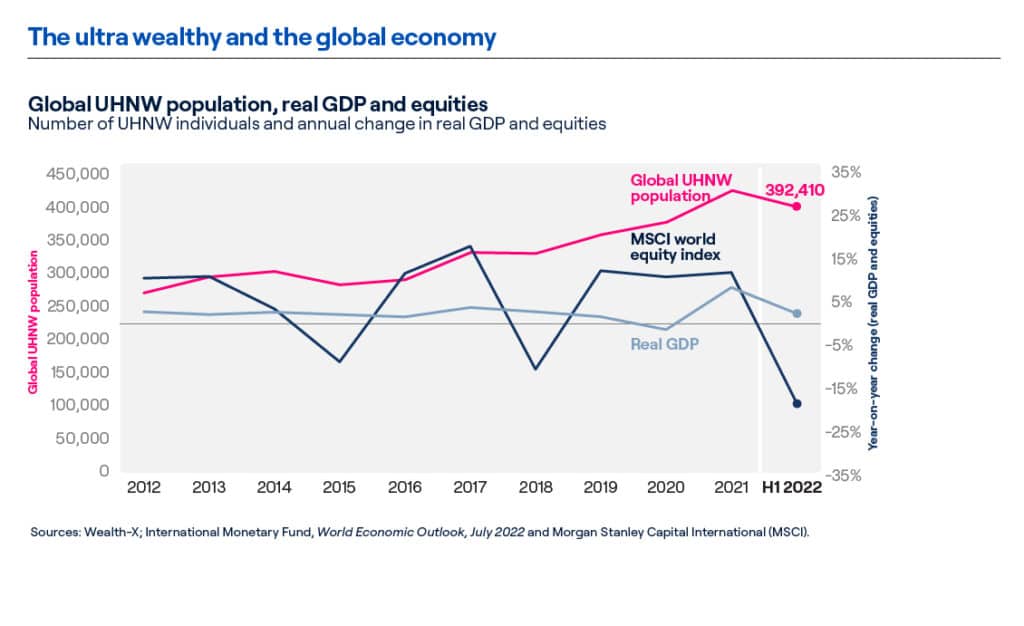

In the first half of 2022, the global ultra high net worth (UHNW) population fell by 6%, to 392,410 individuals. This represents a sharp reversal from 2021 and the first downturn in UNHW numbers since 2018, as wealth portfolios were hit by shockwaves across the global economy, triggered by the war in Ukraine. Following historical highs in recent years, combined net worth fell by 11%, to $41.8trn.

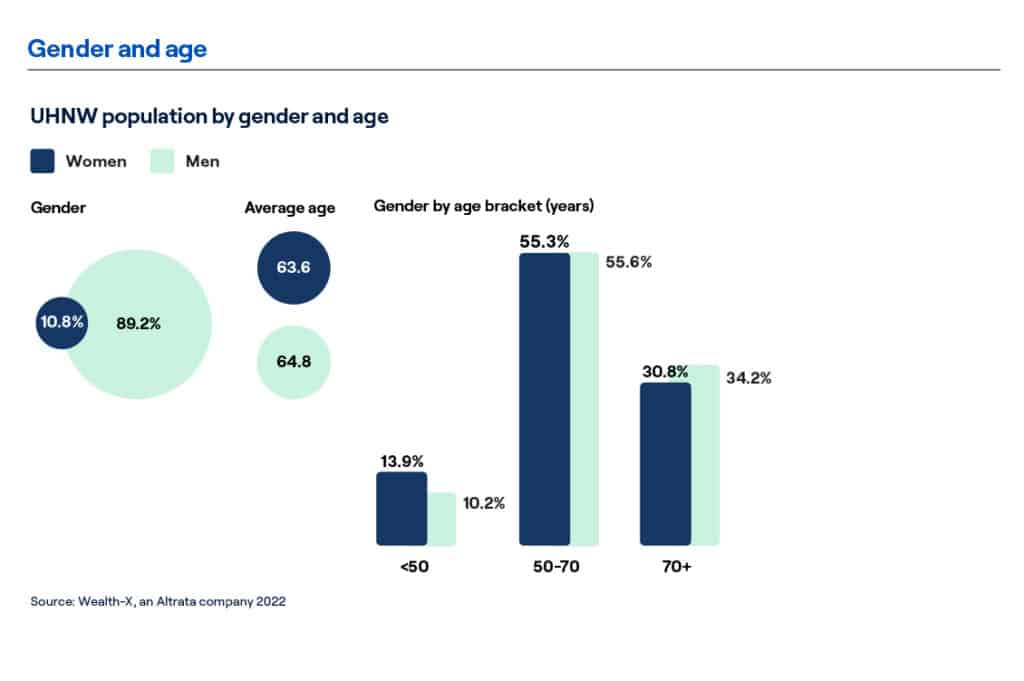

Women account for only 11% of the UHNW population, but this proportion is gradually rising.

UHNW women are, on average, far more likely to have inherited at least some of their wealth; and have a greater interest (or be working directly) in philanthropy. Asset allocation also differs between ultra wealthy women and men: real estate and luxury goods, which account for 13% of all assets among UHNW women, is three times greater than the allocation among their male counterparts.

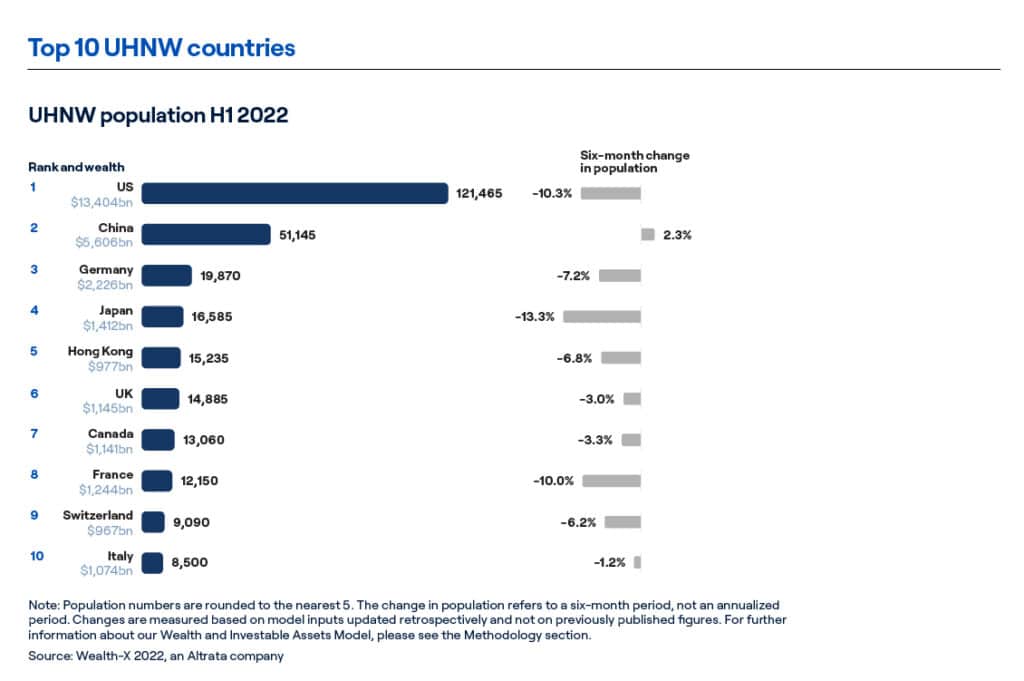

China was the only major wealth market to see a rise in its UHNW population.

Ultra wealthy numbers in the world’s second-largest UNHW country rose by 2.3% over H1 2022. The US was one of three countries (the others being Japan and France) in the top ten to record a double-digit fall. Among the world’s premier UHNW cities, Hong Kong slightly extended its lead over second-placed New York, although both cities recorded declines in their UHNW populations.